6 Simple Techniques For Clark Wealth Partners

Table of Contents6 Easy Facts About Clark Wealth Partners DescribedThe Ultimate Guide To Clark Wealth PartnersGetting My Clark Wealth Partners To Work7 Simple Techniques For Clark Wealth PartnersSome Known Details About Clark Wealth Partners Some Known Details About Clark Wealth Partners The Main Principles Of Clark Wealth Partners Clark Wealth Partners Fundamentals Explained

Common reasons to take into consideration a monetary expert are: If your economic circumstance has ended up being a lot more complicated, or you lack self-confidence in your money-managing skills. Saving or browsing major life events like marriage, divorce, children, inheritance, or job adjustment that might significantly affect your monetary circumstance. Browsing the shift from saving for retired life to preserving riches during retirement and just how to produce a strong retired life earnings strategy.New innovation has actually caused even more comprehensive automated economic devices, like robo-advisors. It depends on you to examine and establish the ideal fit - https://blancarush65.wixsite.com/my-site-1/post/the-ultimate-guide-to-choosing-the-best-financial-advisors-illinois-for-a-secure-future. Inevitably, a great financial consultant needs to be as mindful of your investments as they are with their own, avoiding excessive fees, conserving money on tax obligations, and being as clear as possible concerning your gains and losses

Some Known Factual Statements About Clark Wealth Partners

Gaining a commission on item suggestions doesn't necessarily indicate your fee-based advisor antagonizes your best interests. They might be a lot more likely to recommend items and solutions on which they earn a payment, which may or may not be in your ideal interest. A fiduciary is legitimately bound to place their customer's passions initially.

This basic allows them to make suggestions for investments and solutions as long as they fit their client's goals, risk resistance, and economic scenario. On the various other hand, fiduciary consultants are legally bound to act in their customer's finest passion instead than their own.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

ExperienceTessa reported on all points investing deep-diving into intricate economic topics, dropping light on lesser-known investment opportunities, and uncovering methods viewers can function the system to their advantage. As a personal finance expert in her 20s, Tessa is really familiar with the effects time and uncertainty carry your investment choices.

It was a targeted advertisement, and it functioned. Learn more Check out less.

Clark Wealth Partners - Questions

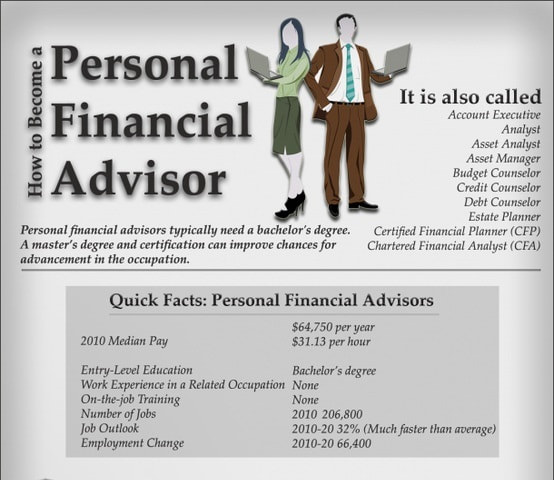

There's no solitary course to ending up being one, with some people starting in banking or insurance policy, while others begin in audit. 1Most economic organizers start with a bachelor's degree in finance, business economics, audit, business, or an associated subject. A four-year degree supplies a strong foundation for professions in investments, budgeting, and customer services.

The Buzz on Clark Wealth Partners

Typical instances include the FINRA Series 7 and Collection 65 tests for safeties, or a state-issued insurance license for offering life or health insurance policy. While qualifications may not be legally needed for all intending duties, employers and customers often see them as a criteria of professionalism and reliability. We check out optional qualifications in the next area.

A lot of economic planners have 1-3 years of experience and familiarity with economic items, conformity requirements, and direct customer communication. A solid academic background is crucial, but experience demonstrates the capability to apply theory in real-world setups. Some programs incorporate both, allowing you to finish coursework while earning monitored hours via teaching fellowships and practicums.

Fascination About Clark Wealth Partners

Numerous get in the field after operating in banking, audit, or insurance, and the shift calls for persistence, networking, and often advanced qualifications. Early years can bring long hours, pressure to construct a customer base, and the requirement to constantly prove your experience. Still, the profession supplies solid long-lasting possibility. Financial coordinators appreciate the possibility to function closely with clients, overview important life choices, and usually achieve versatility in schedules or self-employment.

They spent less time on the client-facing side of the sector. Nearly all economic supervisors hold a bachelor's level, and many have an MBA or comparable graduate level.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

Facts About Clark Wealth Partners Revealed

Optional certifications, such as the CFP, usually call for extra coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, individual monetary experts earn a typical yearly annual wage of $102,140, with leading earners gaining over $239,000.

In various other financial planner scott afb il districts, there are laws that need them to satisfy particular demands to make use of the economic advisor or financial planner titles. For monetary planners, there are 3 typical classifications: Licensed, Individual and Registered Financial Planner.

The Buzz on Clark Wealth Partners

Those on income might have a motivation to advertise the items and services their employers offer. Where to discover a financial consultant will certainly depend upon the type of suggestions you require. These institutions have team that might aid you understand and purchase particular sorts of investments. Term deposits, ensured financial investment certifications (GICs) and common funds.